China has banned exports of the critical minerals gallium, germanium, and antimony to the United States, citing their potential military applications. The move intensifies trade tensions following Washington’s recent measures targeting China’s semiconductor industry.

A directive from China’s Commerce Ministry, addressing dual-use items with both military and civilian applications, emphasized national security concerns. The order, effective immediately, also mandates stricter end-use reviews for graphite exports to the United States, a material crucial for manufacturing electric vehicle batteries.

“In principle, the export of gallium, germanium, antimony, and superhard materials to the United States shall not be permitted,” the ministry said.

The restrictions reinforce previously implemented export controls on critical minerals introduced by Beijing last year but are specifically targeted at the U.S. market. This marks a further escalation in trade tensions between the world’s two largest economies, occurring just before President-elect Donald Trump assumes office.

The United States is evaluating the new restrictions and has indicated it will take “necessary steps” in response, though specific actions have not been disclosed.

“These new controls only underscore the importance of strengthening our efforts with other countries to de-risk and diversify critical supply chains away from PRC (China),” the spokesperson said.

Representatives for President-elect Donald Trump have not yet responded to requests for comment.

Chinese customs data indicate that there have been no shipments of wrought or unwrought germanium or gallium to the United States from January to October this year. However, the U.S. ranked as the fourth- and fifth-largest market for these minerals, respectively, during the same period last year.

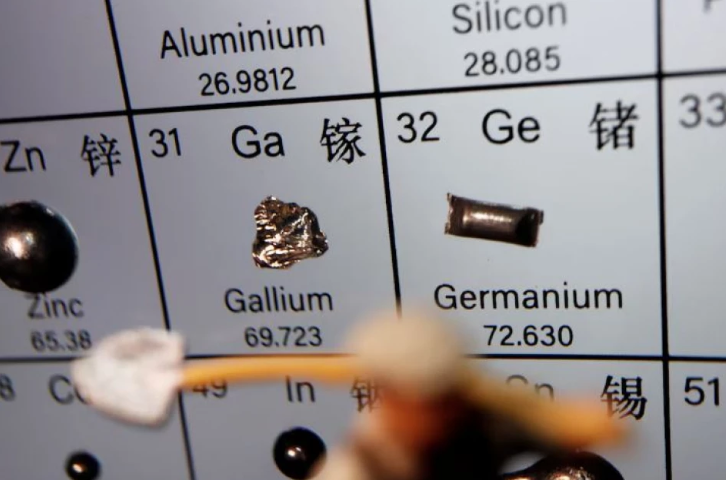

Gallium and germanium are critical materials used in semiconductors, with germanium also playing a role in infrared technology, fiber optic cables, and solar cells.

In addition to the ban on these minerals, China’s overall shipments of antimony products saw a dramatic 97% decline in October from the previous month, following Beijing’s implementation of new export restrictions.

China is a dominant player in the global supply of these minerals, accounting for 48% of the world’s mined antimony last year. Antimony is vital for the production of ammunition, infrared missiles, nuclear weapons, night-vision goggles, as well as batteries and photovoltaic equipment.

This year, China has been responsible for 59.2% of refined germanium production and an overwhelming 98.8% of refined gallium output, according to consultancy Project Blue.

“The move is a considerable escalation of tensions in supply chains where access to raw material units is already tight in the West,” said Project Blue co-founder Jack Bedder.

The price of antimony trioxide in Rotterdam has surged by 228% since the start of the year, reaching $39,000 per metric ton as of November 28, according to data from information provider Argus.

“Everyone will dig in their backyard to find antimony. Many countries will try to find antimony deposits,” said a minor metals trader in Europe, declining to be named.

Representatives from Perpetua Resources, which is developing an antimony mine in Idaho with financial support from the U.S. government, and United States Antimony, which refines antimony in Montana, were not immediately available for comment.

READ MORE:

- University Strike Escalates prompting Urgent Intervention from the CS

- Sakaja approves leasing of spaces in Uhuru, Central Parks

China’s move has sparked fresh concern that Beijing could next target other critical minerals, including those with even broader usage such as nickel or cobalt.

“China has been signalling for some time that it’s willing to take these steps, so when is the U.S. going to learn its lesson?” said Todd Malan of Talon Metals, which is trying to develop a nickel mine in Minnesota and is exploring for the metal in Michigan. The only U.S. nickel mine will be depleted by 2028.

“If the U.S. doesn’t learn the lesson now, what happens when China blocks exports of nickel or other critical minerals?”

China’s announcement comes after Washington launched its third crackdown in three years on China’s semiconductor industry on Monday, curbing exports to 140 companies, including chip equipment maker Naura Technology Group.

Trump, whose first White House term was marked by a bitter trade war with China, has said he will implement 10% tariffs on Chinese goods and threatened 60% tariffs on Chinese imports during his presidential campaign.

“It comes as no surprise that China has responded to the increasing restrictions by American authorities, current and imminent, with its own restrictions on the supply of these strategic minerals,” said Peter Arkell, chairman of the Global Mining Association of China.

“It’s a trade war that has no winners,” he said.

Separately, several Chinese industry groups on Tuesday called for their members to buy domestically made semiconductors, with one saying U.S. chips were no longer safe and reliable.